See how this young couple transformed used shabby house into a dream home!

This young couple literally re-built their dream house from scratch, a second-hand home worth around RM100,000 had been transformed into a whole new cozy little luxury home, setting an exemplary precedent that many young couples with a restricted budget could follow suit!

At times of inflation like now, property prices have soared tremendously. Many youngsters are unable to afford the huge cost of owning a house. Thus, many young people nowadays tend to opt for DIY options, doing everything hands-on trying not to rely on other parties. This is because more parties would definitely indicate higher costs. A netizen from Pahang recently shared his/her experience from purchasing a house to renovating it into something entirely different, showing everyone how a dilapidated house was transformed into a jaw-dropping, admirable little luxury home, all with the effort of the couple’s ingenuity and diligent planning. Hence, we plan to share their story here, so to inspire other young couples out there who are tight on budget!

1. How much money did you spend on purchasing this house? How much time and money did the renovation cost?

I bought this second-hand house in 2015 for RM165,000, the renovation costs around RM65,000 and it took place over a period of three and a half months. The expenditures for furnitures and electrical appliances were approximately RM30,000.

2. Why did you decide to purchase a second-hand house and not a new one instead? Did you go through a property agent or did you do your own research?

House value - RM165,000

Renovation - RM65,000

Furnitures and fittings - RM30,000

Mortgage loan - RM149,000

Renovation loan - RM33,000

Legal fees - RM1,800

Overall expenses - Around RM80,000

Monthly housing loan repayment - RM1,100

Many homeowners offer to sell their homes at prices higher than what banks value the properties to be, ultimately the loan granted is only 90% of the sales price. For example, if the offer price is RM260,000, and bank values it at RM210,000, the approved loan amount will only be RM189,000, therefore you will need to fork out about RM75,000 just to purchase the house itself, not inclusive of renovations and furnitures expenses yet.

Prices of new properties are on the high, we fear not being able to afford the expenses in later years, and we happened to stumble upon this second-hand leasehold property by chance. So, we took some time discussing over the matter and finally decided upon making the purchase, we made the decision so that we can have extra disposable money to pay for renovation costs and to purchase furnitures. The price of this house itself is cheap due to its leasehold tenure, with 22 years gone past, the tenure is left with 77 years. The former homeowner of this unit was worried that it will become harder to sell as time goes by and decided to let it go to us.

My wife and I were not buying a house for investment purpose, our only intention was to have a cozy and comfortable home of our own. Therefore we chose not to care too much about the remaining 77 years tenure and went ahead with the purchase. As for the renovation, the idea was generated from our own preferences, even though the initial expenses were rather hefty, the subsequent monthly loan repayment amount is very affordable, in line with our current standard of living and financial affordability. We are very delighted that many people out there admire the beautiful end result, but the best and most pleasant part of it all is that we now have a home that we both adore.

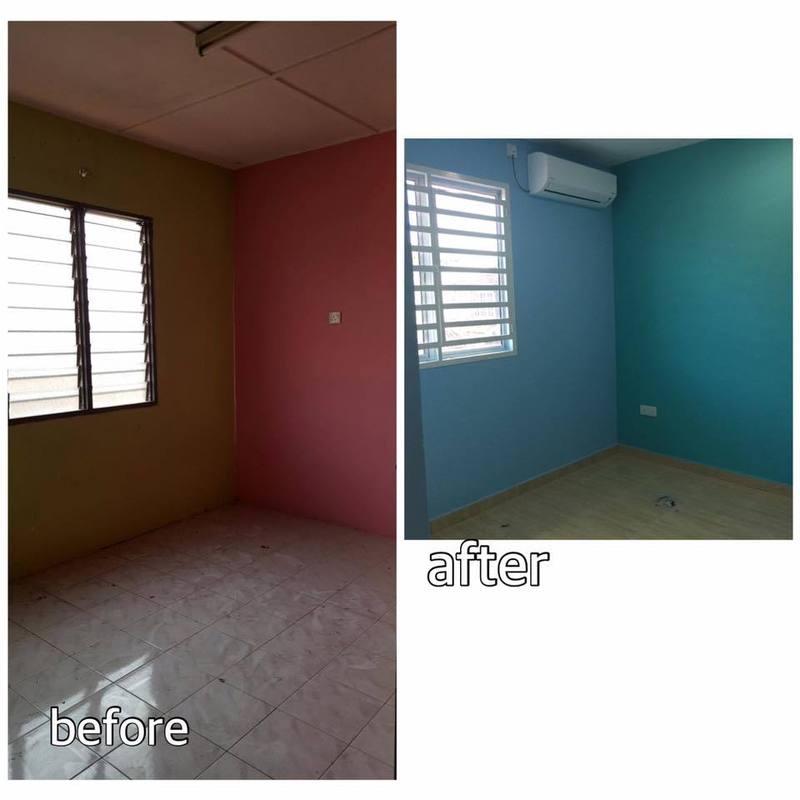

This is how the house originally looked like: pre-transformation…. (so much anticipation!)

In the process of transformation….

Post-transformation (please hold your jaw to prevent it from dropping).

There is a Chinese saying that goes by stating that a fat person is a good prospect, but we personally think that a second-hand shabby house is a golden prospect too! But in order to create a dream home like what this young couple here have achieved, one would require great persistence and perseverance. So, fellow young couples out there, are you ready to take this on?

(Translated by Yau Yin Wey, 28th June 2016)